MORTGAGE 101

What is a mortgage?

A mortgage is a loan that you use to buy or refinance a one to four unit single family home. The lender gives you the money to finance the home, and you agree to pay it back over time, plus interest. The home that you buy serves as collateral for the loan, which means that if you don't make your payments, the lender can take your home.

How do I qualify for a mortgage?

Qualification for a mortgage is dependent on several factors

- Your credit score: Lenders will look at your credit score to determine your risk as a borrower. A good credit score is typically in the 680-760 range.

- Your debt-to-income ratio: Lenders will also look at your debt-to-income ratio (DTI), which is the percentage of your monthly income that goes towards Qualifying debt payments. A good DTI is typically below 36%.

- Your down payment: The amount of money you put down as a down payment will also affect your mortgage qualification. A larger down payment will make you a more attractive borrower and may qualify you for a lower interest rate.

- Your employment history: Lenders will want to see that you have a stable job history and that you are likely to be able to make your mortgage payments on time.

- Your assets: Lenders will also want to see that you have enough assets to cover your closing costs and other expenses associated with buying a home.

If you meet all of these requirements, you will be considered a qualified borrower and you will be able to apply for a mortgage.

Here are some additional tips for qualifying for a mortgage:

- Get pre-approved for a mortgage before you start shopping for a home. This will give you an idea of how much you can afford and will make the home buying process go more smoothly.

- Shop around for the best interest rate. Interest rates can vary from lender to lender, so it is important to compare rates before you choose a lender.

- Be prepared to provide documentation. Lenders will need to see proof of your income, assets, and employment history.

- Ask questions. If you have any questions about the mortgage process, be sure to ask your lender.

What are the costs of a mortgage?

In addition to the monthly mortgage payments, there are other costs associated with buying a home, such as:

- Down payment: The down payment is the portion of the purchase price that you pay upfront. Typically, a down payment of 20% is required to avoid paying private mortgage insurance (PMI).

- Closing costs: Closing costs are the fees associated with getting a mortgage. These costs can vary, but they typically range from 2-5% of the purchase price.

- Property taxes: Property taxes are taxes that you pay to the local government each year. The amount of property tax you pay will depend on the value of your home and the tax rate in your area.

- Homeowners insurance: Homeowners insurance is insurance that protects your home from damage caused by fire, theft, and other hazards. The cost of homeowners insurance will depend on the value of your home and the type of coverage you choose.

What are the benefits of owning a home?

- There are many benefits to owning a home, such as:

- Building equity: When you make a mortgage payment, a portion of your payment goes towards paying down the principal balance of your loan. This means that you are building equity in your home over time.

- Tax deductions: You may be able to deduct some of the costs of homeownership, such as mortgage interest and property taxes, on your federal income taxes.

- Stability: Homeownership can provide stability and security. When you own your own home, you are not subject to rent increases or eviction.

- Pride of ownership: There is a sense of pride and accomplishment that comes with owning your own home.

If you are thinking about buying a home, it is important to do your research and understand the different options available to you. Working with a qualified mortgage lender can help you find the right mortgage for your needs and budget.

Are you ready to buy a home?

Buying a home is a big decision, and it's important to make sure you're ready before you start the process. Here are a few things to consider:

- Do you have a stable job and income?

- Do you have a stable job and income?

- Can you afford a down payment?

- Do you have a good credit score?

- Are you prepared for the unexpected costs of homeownership?

If you can answer yes to all of these questions, then you may be ready to start looking for a home. However, if you're not sure, it's a good idea to talk to a financial advisor or a mortgage lender. They can help you assess your financial situation and make sure you're ready for the commitment of homeownership.

Here are some of the benefits of homeownership:

- Build equity: As you make mortgage payments, you'll build equity in your home. This means that you'll own a portion of your home outright, and you'll have something to show for your investment.

- Tax deductions: You may be able to deduct some of the costs of homeownership, such as mortgage interest and property taxes, on your federal income taxes.

- Stability: Homeownership can provide stability and security. When you own your own home, you're not subject to rent increases or eviction.

- Pride of ownership: There's a sense of pride and accomplishment that comes with owning your own home.

Here are some of the costs of homeownership:

- Mortgage: The mortgage is the largest expense associated with homeownership. Your monthly mortgage payment will include principal, interest, property taxes, and homeowners’ insurance.

- Closing costs: Closing costs are the fees associated with getting a mortgage. These costs can vary, but they typically range from 2-5% of the purchase price.

- Property taxes: Property taxes are taxes that you pay to the local government each year. The amount of property tax you pay will depend on the value of your home and the tax rate in your area.

- Homeowners insurance: Homeowners insurance is insurance that protects your home from damage caused by fire, theft, and other hazards. The cost of homeowners insurance will depend on the value of your home and the type of coverage you choose.

- If you're thinking about buying a home, it's important to do your research and understand the different options available to you. Working with a qualified mortgage lender can help you find the right mortgage for your needs and budget.

Credit Score

- Your credit score is also important when determining how much money you need to put down for a home. Borrowers with good credit scores (740 or higher) may be able to get a lower interest rate on their mortgage, which can save them money in the long run.

Income

Your income is also a factor that lenders will consider when determining how much money you need to put down for a home. Lenders want to make sure that you can afford to make your monthly mortgage payments, even if your income changes.

How Much Money Do I Need to Put Down?

The answer will depend on your individual circumstances. It is a good idea to talk to a mortgage lender to get an accurate estimate of how much money you need to put down.

Benefits of a Larger Down Payment

- There are several benefits to making a larger down payment on a home. A larger down payment can:

- Lower your monthly mortgage payments.

- Reduce the amount of interest you pay over the life of your loan.

- Eliminate the need for private mortgage insurance (PMI)

- Increase your chances of getting approved for a mortgage.

- If you are thinking about buying a home, it is important to start saving for a down payment. The more money you can save, the better off you will be in the long run.

Down-Payment Assistance

Our company is well equipped to assist families utilizing down payment assistance programs. We have a team of experienced loan officers who can help you find the right program for your needs. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

We understand that buying a home can be a daunting task, but we are here to help you every step of the way. Contact us today to learn more about how we can help you achieve your dream of homeownership.

Here are some additional benefits of down payment assistance programs:

- Reduced monthly mortgage payments: A lower down payment means that you will have to borrow less money, which can result in lower monthly mortgage payments.

- Increased borrowing power: A lower down payment can also increase your borrowing power, which means that you may be able to afford a more expensive home.

- Improved credit score: Making timely payments on a down payment assistance loan can help improve your credit score, which can make it easier to qualify for other loans in the future.

If you are considering buying a home, be sure to explore all of your down payment assistance options. Down payment assistance can make it easier to afford a home and can help you achieve your dream of homeownership.

Public Down Payment Assistance Programs

- Government Appointed Agencies: The leadership and management of these agencies are appointed by state or local government. The geographic and applicant qualification restrictions will match the needs of the government jurisdiction.

- Grants: Grants are free money that you do not have to repay. They can be used for your down payment, closing costs, or other homebuying expenses.

- Forgivable Subordinate Financing: sometimes assistance is provided in the form of a subordinate lien. The lien is often forgiven after a period of time.

- Mortgage credit certificates (MCCs): MCCs are a tax credit that can be used to offset the cost of your mortgage interest. They can be worth up to 20% of your mortgage interest, which can save you thousands of dollars over the life of your loan.

Private Down Payment Assistance Programs

- Nonprofit organizations: Many nonprofit organizations offer down payment assistance programs to help low- and moderate-income families buy homes. These programs can provide grants, loans, or other forms of assistance.

- Employers: some employers offer down payment assistance as part of their employee benefits program.

- Builders and developers: Some builders and developers offer down payment assistance programs as a way to attract buyers. These programs can vary in terms of eligibility requirements and the amount of assistance that is available.

CONTACT US NOW FOR AVAILABILITY

Buy vs Rent (when interest rates are high)

f you are a renter who would like to get into homeownership yet fear how you will be able to afford one with today’s interest rates… then Trust Us, The Loan Nerd has created this page just for YOU! And if you are not a renter but know of one… please feel free to share this page!!

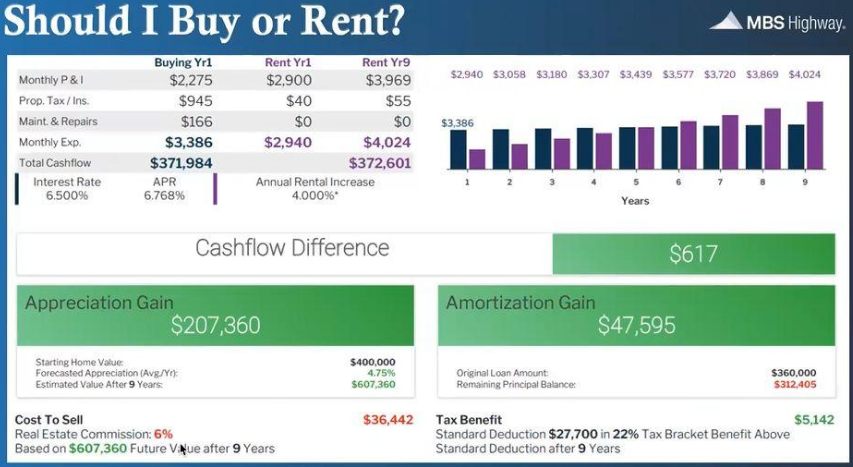

You are interested in purchasing a home that is listed for $400,000 and decide to put in a full purchase price offer of $400,000 with a loan amount of $360,000 and an interest rate of 6.5%.

In case you believe I am biased in favor of buying, I will make this home purchase example as ugly as possible.

Let’s begin with the assumptions on the ‘buy’ side:

- You stay in the home for 9 years (the average length of time today’s homeowner remains in their home)

- Rates never drop and you do not refinance at a lower interest rate

- Property taxes increase at a rate of 2% per year

- Homeowners insurance increases at a rate of 2% per year

- Estimated repair expenses are $2000 per year and increase x% per year

- Your home does not continue to appreciate at the current record-setting pace. Instead, we will assume that your home will appreciate at the historical appreciation rate of 4.75% per year

- When you sell your home at the end of the 9 years, you will pay an agent commission of 6% of the sales price

- You paid $8000 in closing costs when you purchased your home. These are fees paid to the lender and other service providers who assisted in obtaining your home loan and property deed.

If you were to rent a comparable $400,000 house:

- A typical monthly rent payment on a $400,000 home would be $3,000 per month or more. However, you are a really good negotiator and bargained for a rent of $2,900 per month.

- Historically, rents increase approximately 5% per year. In the spirit of keeping this conservative… you negotiated a maximum rate increase of 4% a year.

- You also negotiated a killer deal on your renter’s insurance at $40 per month, increasing 4% per year

Now, let’s look at the math.

There are 3 components: total cashflow, appreciation gain, and amortization gain

Total Cashflow

When we look at the monthly expense in year 1, you pay $3,386 per month to buy your home and $2,940 per month to rent your home. This is an additional $446 per month to buy your home. Because you purchased your home with a fixed rate mortgage, the principal and interest portion of your payment will never go up. Looking at the graph above, your rent payment dramatically outpaces your mortgage payment. At the end of the 9 years, you will have paid a total of $371, 984 to buy your home and $372,601 to rent a comparable home. The cashflow difference is a mere $617 at the end of 9 years. You can see that, by staying in your home longer, the cashflow savings of buying vs. renting would weigh heavily in favor of buying.

Amortization Gain

Amortization gain is like a savings plan. You borrowed money from the lender to purchase your home. Every time you make a payment on your mortgage loan, it is like you are transferring money from your checking account into home equity/ownership.

As I mentioned, every time you make a loan payment a portion of your payment goes to principal and interest. The principal payment reduces the amount of money you owe (principal or loan amount) and the interest payment is the cost of borrowing the money from the lender. Overtime, a larger part of your payment goes toward principal repayment and a smaller part of your payment goes toward interest. This is called amortization. In this example, it is called positive amortization and results in a gain for you.

In our example, your original loan amount was $360,000. At the end of 9 years, instead of owing $360,000, you only owe $312,405. This amortization gain is like a cash savings of $47,595! It is drastically different than making a rent payment to your landlord.

Appreciation Gain

Appreciation is the change in property value over the 9 year period. We can add this to your wallet in favor of buying your home – and it is a BIG deal!

Let’s remember that I forecast the annual increase in value (appreciation) very conservatively. I chose to use 4.75% per year because this is the historical average appreciation per year over the last 63 years. In recent years, we know that increases in home values have far outpaced the historical average, presenting a challenging position for the homebuyer.

Generally, appreciation and interest rates are related so that when home values increase dramatically, so do interest rates. Conversely, when home values slow, interest rates decline. This means that, if the housing prices slow you may have the opportunity to refinance your mortgage at a lower rate. Either way, this is a winning situation for a homeowner!

In our example, your initial purchase price was $400,000. With an annual appreciation of 4.75%, your home will be worth a whopping $607,360 at the end of 9 years – a gain of $207,360!

Let’s keep in mind that you will need to sell your house to realize the appreciation gain and you will need to pay the an agent commission, estimated at 6% of the sales price. 6% of a $607,360 sales price is $36,442. This reduces your appreciation gain to $170,918, which is still a very respectable gain.

Bonus - Tax Benefit

You will want to check with a tax professional on this one… mortgage interest on your residence is tax deductible! Based on a 22% tax bracket, this would save you $5,142 over the standard deduction after 9 years.

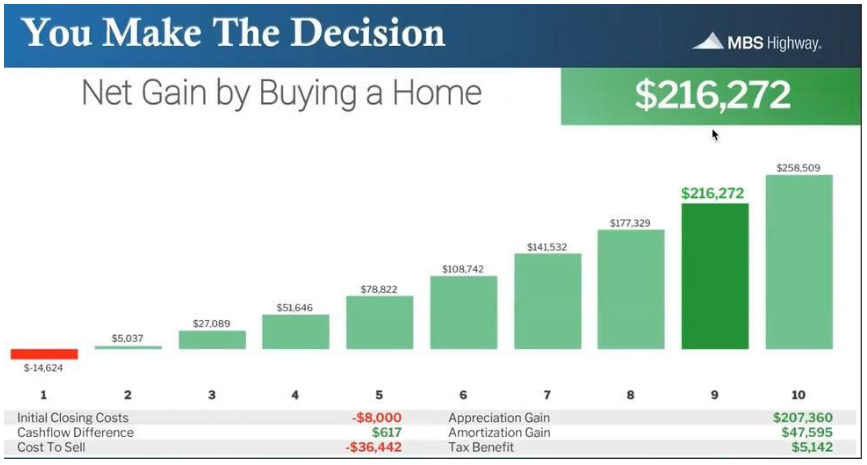

Let’s put it all together…

The above graph includes all the costs we talked about. It shows homeownership can generate personal wealth over a period of time.

Remember that when we looked at the cashflow, we only saved $617 over the course of 9 years. When we add in the amortization and appreciation gains and subtract out initial closing costs and cost to sell, we save $216,272 over the same 9 years!

You may be thinking, ‘Of course I want to buy a home! Where do I sign up?’

Let’s slow the horses. It might not be the right time for homeownership for you, right now.

According to the above graph, if you sold your house at the end of year 1, you would lose $14,624. This is because the cost to buy and sell overwhelmed the benefit of homeownership in the short term. By the end of year 2, you would have been ahead $5,037. Given this scenario, if you planned to stay in your home less than 2 years, I would recommend that you continue to rent at this time.

The bottom line is that making a decision about when and if to purchase a home can be tricky. Your experienced Loan Nerd is here to discuss your personal and financial goals with you and help you navigate the path to homeownership. We can tailor a scenario specific to your needs.

It is generally best to meet with a Loan Nerd first, before hunting for houses. Your Loan Nerd can help define your budget – including purchase price, tax and special tax districting, homeowner’s and flood insurance, and even homeowners’ association fees. We can outfit you with a pre-approval letter to share with your real estate agent so they have the information to help you find your perfect ‘right now’ home and the ammunition to make sure your offer is accepted.

CONTACT US NOW FOR AVAILABILITY

Do’s and Don’ts

Do's:

- Get pre-approved for a mortgage before you start looking at homes. This will give you an idea of how much you can afford to borrow and will make the homebuying process go more smoothly.

- Be prepared to provide documentation of your income, employment, and assets. Lenders will need this information to assess your creditworthiness.

- Shop around for the best interest rate. Interest rates can vary from lender to lender, so it is important to compare rates before you choose a lender.

- Be patient. The homebuying process can be long and complicated, but it is worth it in the end.

Don'ts:

- Don't wait until the last minute to get pre-approved for a mortgage. This could delay the homebuying process and make it more difficult to find a home that you can afford.

- Don't be afraid to ask questions. The mortgage qualification process can be confusing, so don't be afraid to ask your lender questions about anything that you don't understand.

- Don't make any major purchases before you close on your home. This could impact your debt-to-income ratio and make it more difficult to qualify for a mortgage.

- Don't sign anything that you don't understand. Before you sign any paperwork, be sure to read it carefully and ask questions if you don't understand something.

By following these do's and don'ts, you can increase your chances of qualifying for a mortgage and buying the home of your dreams.

Here are some additional tips that may be helpful:

- Get your credit report and make sure it is accurate. Any errors on your credit report could impact your ability to qualify for a mortgage.

- Start saving for a down payment. A larger down payment will lower your monthly mortgage payments and make you a more attractive borrower to lenders.

- Get a good idea of your monthly housing costs. This includes your mortgage payment, property taxes, homeowners insurance, and utilities.

- Consider a fixed-rate mortgage. This will give you peace of mind knowing that your interest rate will not change over the life of your loan.

- Shop around for a lender. Interest rates can vary from lender to lender, so it is important to compare rates before you choose a lender.

- Get everything in writing. This includes the terms of your mortgage, the closing costs, and any other fees associated with the loan.

Buying a home is a big decision, but it can also be an exciting one. By following these tips, you can increase your chances of getting approved for a mortgage and finding the perfect home for you.

Here are some additional tips that may be helpful:

- Get your credit report and make sure it is accurate. Any errors on your credit report could impact your ability to qualify for a mortgage.

- Start saving for a down payment. A larger down payment will lower your monthly mortgage payments and make you a more attractive borrower to lenders.

- Get a good idea of your monthly housing costs. This includes your mortgage payment, property taxes, homeowners insurance, and utilities.

- Consider a fixed-rate mortgage. This will give you peace of mind knowing that your interest rate will not change over the life of your loan.

- Shop around for a lender. Interest rates can vary from lender to lender, so it is important to compare rates before you choose a lender.

- Get everything in writing. This includes the terms of your mortgage, the closing costs, and any other fees associated with the loan.

Buying a home is a big decision, but it can also be an exciting one. By following these tips, you can increase your chances of getting approved for a mortgage and finding the perfect home for you.

Lease or buy?

Interest rate or cost of ownership? – the right financing is critical to your family’s financial health.

- When you're buying a home, there are two important factors to consider when choosing a mortgage: interest rate and cost of ownership. The interest rate is the percentage of the loan amount that you pay in interest over the life of the loan. The cost of ownership is the total amount of money you'll spend on your home each year, including mortgage payments, property taxes, homeowners insurance, and other expenses.

- Interest rate: A lower interest rate will save you money on your monthly mortgage payments. However, it's important to remember that interest rates are just one factor that affects the cost of your mortgage. The term of your loan, the amount of your down payment, and the type of mortgage you choose will also affect your monthly payments.

- Cost of ownership: The cost of ownership is more than just your monthly mortgage payment. You'll also need to factor in property taxes, homeowners’ insurance, and other expenses. Property taxes are typically assessed by the local government and are based on the value of your home. Homeowners insurance protects your home from damage caused by fire, theft, and other hazards. The cost of homeowners insurance will depend on the value of your home and the type of coverage you choose.

- The right financing is critical to your family's financial health: When you choose the right mortgage, you can save money and build your financial security. Our team of experienced loan officers can help you find the right mortgage for your needs and budget. We offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans. We can also help you with down payment assistance and other programs that can make homeownership more affordable.

- Contact us today to learn more about how we can help you achieve your dream of homeownership.

- We can add more details and information as needed. But this should give you a good starting point.

Understanding Credit Use and how it affects credit scores.

Your credit score is a number that lenders use to determine how likely you are to repay a loan. It is based on a variety of factors, including your payment history, the amount of debt you have, and the length of your credit history.

There are two main types of credit scores: FICO® scores and VantageScore® scores. FICO® scores are the most commonly used credit scores, and they are used by Mortgage Lenders. VantageScore® scores are a newer type of credit score, and they are yet to be adopted by the Mortgage Industry.

Your credit score can range from 300 to 850. A higher credit score means that you are a lower risk to lenders, and you may qualify for lower interest rates and better loan terms.

There are a few things that you can do to improve your credit score:

- Pay your bills on time. This is the most important factor in determining your credit score.

- Keep your credit utilization low. Credit utilization is the amount of debt you have compared to your available credit. A good goal is to keep your credit utilization below 30%. Do not close out open revolving credit lines even if they are at a zero balance, this can have an adverse effect on your credit scores.

- Lengthen your credit history. The longer your credit history, the better.

- Avoid applying for too much credit too often. Hard inquiries, which are when you apply for new credit, can temporarily lower your credit score.

If you are looking to improve your credit score, there are a few things that you can do:

- Get a copy of your credit report and review it for errors. If you find any errors, dispute them with the credit bureaus.

- Use a credit monitoring service. A credit monitoring service can help you track your credit score and report any suspicious activity.

- Consider working with a credit counselor. A credit counselor can help you develop a plan to improve your credit score.

By understanding credit use and how it affects credit scores, you can take steps to improve your credit score and get approved for the loans that you need.

Contact our team today to learn more about how we can help you improve your credit score and get approved for a loan.

CONTACT US NOW FOR AVAILABILITY

Special Situations

Self-Employed

- We are familiar with different business structures; Sole Proprietorship, Limited Liability Corporation (LLC), Partnerships, Corporations and S-Corporations.

- Self-employed borrowers typically need to provide two years of tax returns. However, our team specializes in handling complicated tax returns and often can qualify using only the most recent year of tax returns, which can eliminate underwriting scrutiny over income fluctuation.

- Finally, we provide income analysis for self-employed borrowers up front so there are no surprises during underwriting.

- We also understand that self-employed borrowers face unique challenges when qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

- We are committed to helping you achieve your dream of homeownership. Contact us today to learn more about how we can help you.

Investor Loans

- We understand that investors face unique challenges when qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced Loan Nerds who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

- We can finance single family 1-to-4-unit properties for investment purposes with as little as 15% down. Our experienced team can put together financing packages curtailed to meet your specific needs, such as maximizing cash flow and accelerating asset value.

- We are committed to helping you achieve your investment goals. Contact us today to learn more about how we can help you.

Asset Qualifying Loans

Asset qualifying: Asset qualifying is a type of mortgage that allows borrowers to qualify for a loan based on their assets, such as cash, investments, and retirement accounts. This can be a good option for borrowers who have a high debt-to-income ratio or who have a history of bad credit.

- Asset dissipation: Asset dissipation is a type of mortgage that allows borrowers to qualify for a loan by pre-supposing using their assets over time to cover their debt servicing. This can help borrowers improve their debt-to-income ratio and make them more attractive to lenders.

- Both asset qualifying and asset dissipation can be good options for borrowers who are looking to finance a home. However, it is important to note that these types of loans may have higher interest rates and fees than traditional mortgages.

- Here is a summary statement that assures the reader that our company is well equipped to assist families wanting to qualify for a mortgage:

- We understand that borrowers have different needs when it comes to qualifying for a mortgage. We are here to help you find the right loan for your needs. We have a team of experienced loan officers who can help you understand the different types of loans available and can help you find the loan that best meets your needs.

- We are committed to helping you achieve your homeownership goals. Contact us today to learn more about how we can help you.

Individual Taxpayer Identification Number (ITIN) – No Social Security Number

- Borrowers with an ITIN may have a more difficult time qualifying for a mortgage than borrowers with a Social Security Number. This is because lenders have less information about borrowers with ITINs, which makes it more difficult for them to assess their creditworthiness.

- Borrowers with an ITIN may need to provide additional documentation to lenders, such as two years of tax returns and proof of employment. They may also need to have a higher credit score and a lower debt-to-income ratio than borrowers with a Social Security Number.

- Despite these challenges, it is still possible for borrowers with ITINs to qualify for a mortgage. There are a few lenders who specialize in mortgages for borrowers with ITINs. These lenders have experience working with borrowers who have limited credit history or who are not US citizens.

- We understand that borrowers with ITINs may face unique challenges when it comes to qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

- We are committed to helping you achieve your dream of homeownership. Contact us today to learn more about how we can help you

Foreign Nationals

- Foreign nationals may have a more difficult time qualifying for a mortgage than US citizens. This is because lenders have less information about foreign nationals, which makes it more difficult for them to assess their creditworthiness.

- Foreign nationals may need to provide additional documentation to lenders, such as two years of tax returns from their home country, proof of employment, and a letter from their employer stating that they are authorized to work in the United States. They may also need to have a higher credit score and a lower debt-to-income ratio than US citizens.

- Despite these challenges, it is still possible for foreign nationals to qualify for a mortgage. There are a number of lenders who specialize in mortgages for foreign nationals. These lenders have experience working with borrowers who have limited credit history or who are not US citizens.

- We understand that foreign nationals may face unique challenges when it comes to qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

Multiple jobs

- Borrowers with multiple jobs or multiple sources of income may have a more difficult time qualifying for a mortgage than borrowers with a single job or a single source of income. This is because lenders have less information about borrowers with multiple jobs or multiple sources of income, which makes it more difficult for them to assess their creditworthiness.

- Borrowers with multiple jobs or multiple sources of income may need to provide additional documentation to lenders, such as two years of tax returns and proof of employment for all jobs. They may also need to have a higher credit score and a lower debt-to-income ratio than borrowers with a single job or a single source of income.

- Despite these challenges, it is still possible for borrowers with multiple jobs or multiple sources of income to qualify for a mortgage. There are a number of lenders who specialize in mortgages for borrowers with multiple jobs or multiple sources of income. These lenders have experience working with borrowers who have a variety of income streams.

- We understand that borrowers with multiple jobs or multiple sources of income may face unique challenges when it comes to qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and

Seasonal employment

- Borrowers with seasonal employment may have a more difficult time qualifying for a mortgage than borrowers with steady employment. This is because lenders are more cautious about lending money to borrowers who have a history of inconsistent income.

- Borrowers with seasonal employment may need to provide additional documentation to lenders, such as two years of tax returns and proof of employment. They may also need to have a higher credit score and a lower debt-to-income ratio than borrowers with steady employment.

- Despite these challenges, it is still possible for borrowers with seasonal employment to qualify for a mortgage. There are a number of lenders who specialize in mortgages for borrowers with seasonal employment. These lenders have experience working with borrowers who have variable income or who are not employed year-round.

- We understand that borrowers with seasonal employment may face unique challenges when it comes to qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

Recent graduates

- Recent graduates may have a more difficult time qualifying for a mortgage than borrowers with more established careers. This is because lenders look at a borrower's employment history and income when determining their creditworthiness. Recent graduates may not have a long employment history or a high income, which can make it more difficult for them to qualify for a mortgage.

- Recent graduates may need to provide additional documentation to lenders, such as proof of enrollment in school or certificates of completion and career related non-paying activity. They may also need to have a higher credit score and a lower debt-to-income ratio than borrowers with more established careers.

- Despite these challenges, it is still possible for recent graduates to qualify for a mortgage. There are a number of specific program guidelines that allow for recent graduates to qualify. Our Nerds have experience working with borrowers who have limited credit history or who are just starting their careers.

- We understand that recent graduates may face unique challenges when it comes to qualifying for a mortgage. We are here to help you every step of the way. We have a team of experienced loan officers who can help you understand the requirements and navigate the process. We also offer a variety of other services to help you through the homebuying process, such as pre-qualification, home search assistance, and closing assistance.

- Helpful Tools

- Gift Letter and Instructions

- Ways to Build Good Credit

About us

Equal Housing Lender | Clear Mortgage DBA City 1st Mortgage Services, LLC | Company MLS ID 3117 | NMLS Consumer Access Privacy Notice | Terms | Texas

Consumer Complaint Disclosure | Program and Rate Examples

City 1st Mortgage Services, LLC.

(www.nmlsconsumeraccess.org) is an equal opportunity lender is an FHA-approved lender, a California financial lending institution licensed by the California Department of Financial Protection & Innovation under the California Residential Mortgage Lending Act and is not the FHA, which is a government agency, nor working on behalf of the FHA.

Privacy Policy

Equal Housing Opportunity.

Leave a message!

Have something to tell us?

We’d love to hear it!

Contact Us

We will get back to you as soon as possible.

Please try again later.